Taxability of Free zone entity

- Free Zone- As defined in the Corporate Tax Law

A designated and defined geographic area within the State (UAE) that is specified in a decision issued by the Cabinet at the suggestion of the Minister.

- Designated zone– As per Cabinet Decision No. 100 of 2023 of Corporate Tax Law,

A designated zone according to what is stated in Federal Decree-Law No. (8) of 2017 on Value Added Tax, and which has been included as a Free Zone in accordance with the Corporate Tax Law.

- Free zone person- As defined in the Corporate Tax Law

A juridical person incorporated, established, or otherwise registered in a Free Zone, including a branch of a Non-Resident Person registered in a Free Zone as per Corporate Tax Law

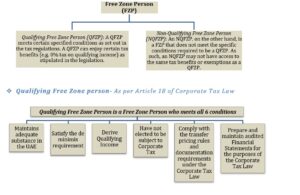

A Free Zone Person (FZP) can be categorized into two:

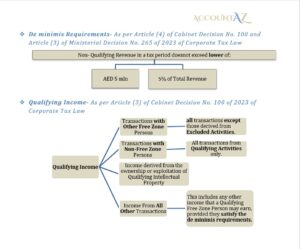

Qualifying Activities- As per Article (2) Ministerial Decision No. 265 of 2023

a) Manufacturing of goods or materials. b) Processing of goods or materials. c) trading of Qualifying Commodities d) Holding of shares and other securities for Investment purposes e) Ownership, management and operation of Ships. f) Reinsurance services g) Fund management services h) Wealth and investment management services. i) Headquarter services to Related Parties. j) Treasury and financing services to Related Parties. k) Financing and leasing of Aircraft, including engines and rotable components. l) Distribution of goods or materials in or from a Designated Zone to a customer that resells such goods or materials m) Logistics services. n) Any activities that are ancillary to the above mentioned a) to m).

Excluded Activities- As per Article (2) Ministerial Decision No. 265 of 2023:

a) Transactions with natural persons, except in relation to certain Qualifying Activities specified under paragraphs e), g) h) and k) of Article 2 Clause 1 ; b) Banking activity, c) insurance activities, without prejudice to f) and i) of Clause 1 above d) Finance and leasing activities without prejudice to e), j) and k) of Clause 1 above that are subject to the relevant regulatory oversight of the relevant competent authority in the UAE, except for certain exceptions. e) Ownership or exploitation of UAE immovable property, other than Commercial Property located in a Free Zone provided such activity in relation to Immovable Property located in a Free Zone is conducted with other Free Zone Persons. f) Activities that are ancillary to the above activities.

Leave a Reply