Understanding the Excise tax

Excise tax was introduced across the UAE in 2017. Excise tax is a form of indirect tax levied on specific goods which are typically harmful to human health or the environment. These goods are referred to as “excise goods”. When considering whether a product is an excise good, the following definitions apply:

- Carbonated drinks include any aerated beverage except for unflavoured aerated water. Also considered to be carbonated drinks are any concentrations, powder, gel, or extracts intended to be made into an aerated beverage.

- Energy drinks include any beverages which are marketed, or sold as an energy drink, and containing stimulant substances that provide mental and physical stimulation, which includes without limitation: caffeine, taurine, ginseng and guarana. This also includes any substance that has an identical or similar effect as the aforementioned substances. Also considered to be energy drinks are any concentrations, powder, gel or extracts intended to be made into an energy enhancing drink.

- Tobacco and tobacco products include all items listed within Schedule 24 of the GCC Common Customs Tariff.

From 1 December 2019, excise tax will be levied also on:

- electronic smoking devices and tools

- liquids used in such devices and tools

- sweetened drinks.

- Rate of excise tax

- According to Cabinet Decision No. 52 of 2019 on Excise Goods, Excise Tax Rates and the Methods of Calculating the Excise Price , the rate of excise tax is as follows:

- 50 per cent on carbonated drinks

- 100 per cent on tobacco products

- 100 per cent on energy drinks

- 100 per cent on electronic smoking devices

- 100 per cent on liquids used in such devices and tools

- 50 per cent on any product with added sugar or other sweeteners.

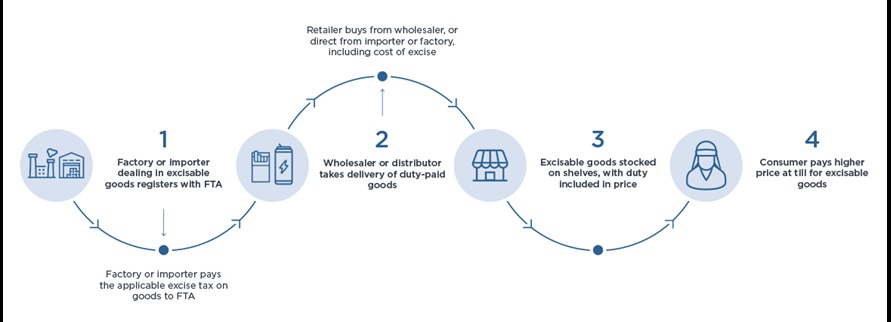

Businesses required to register for excise tax

Under the UAE Federal Decree Law No. 7 of 2017 on Excise Tax,registering for excise tax is the responsibility of any business engaged in:

- the import of excise goods into the UAE

- the production of excise goods where they are released for consumption in the UAE

- the stockpiling of excise goods in the UAE in certain cases

- anyone who is responsible for overseeing an excise warehouse or designated zone i.e. a warehouse keeper.

FTA is committed to providing extensive support and guidance to assist with this; however, the responsibility lies with the business to make sure that any required compliance obligations are fulfilled.

FTA has the power to conduct audits of taxable corporates and subsequently impose penal measures on those that do not comply with the law.

Leave a Reply